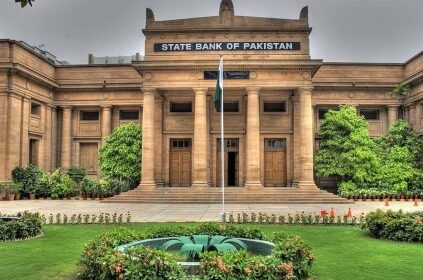

Pakistan has made a major leap in cross-border payments! The State Bank of Pakistan (SBP) announced the integration of Raast, its instant payment system, with the Arab Monetary Fund’s Buna platform, enabling direct payments in Pakistani rupees between Pakistan and Arab countries.

🌟 Key Milestones:

- Raast-Buna Integration: Instant payment in PKR between Pakistan and Arab nations.

- E-Wallet Payments to China: SBP enables cross-border e-wallet transactions for easy e-shopping in China.

- Third National Financial Inclusion Strategy (NFIS 2028): Aims to expand banking services to 75% of adults, focusing on women’s financial inclusion.

🚀 Pakistan’s Financial Integration Journey

📢 SBP is taking digital financial inclusion to the next level! In the Governor’s Annual Report for FY24, Governor Jameel Ahmed detailed the central bank’s plan to promote cross-border digital financial services and boost regional connectivity.

Key Highlights:

- MoU with Arab Monetary Fund: Pakistan Rupee now included as a settlement currency via the Buna payment system.

- Partnership with China: Enables Pakistan’s e-wallet holders to make direct payments for small purchases and e-commerce in China.

🔍 Financial Inclusion: The Road Ahead

SBP has big plans to revolutionize financial inclusion. The NFIS 2028 strategy sets an ambitious target to extend banking services to 75% of the adult population by 2028, with a special focus on reducing the gender gap to 25%.

Key Focus Areas:

- Increase financial inclusion for women, youth, and differently-abled individuals.

- Improve digital financial services for SMEs, agriculture, and microfinance.

- Develop a financial inclusion index to track progress in the country.

📈 Game-Changing Innovations in Agriculture & Livestock Financing 🌾🐄

Electronic Warehouse Receipt Financing (EWRF)

Farmers can now secure financing using physical commodities like maize and rice as collateral. In FY24, Rs 1,891 million was disbursed to farmers, surpassing targets!

Crop Loan Insurance Scheme (CLIS)

To protect farmers from natural disasters, the government covers the insurance premiums for crop loans, benefitting 7 million farmers under the CLIS scheme since 2008.

Livestock Insurance Scheme for Borrowers (LISB)

Farmers can insure up to 10 animals. Nearly 1 million livestock farmers benefited from this scheme by December 2023.