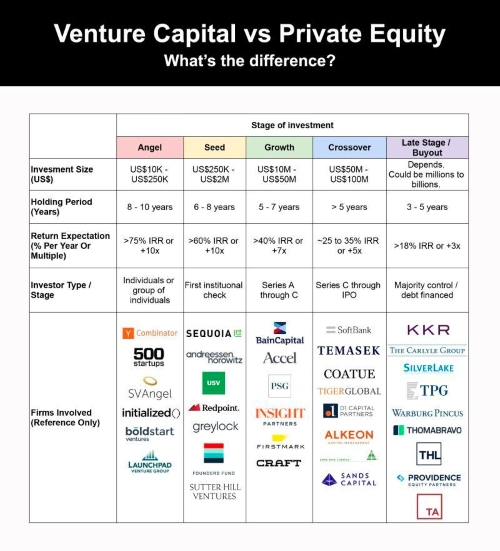

Startups raise funds in distinct stages—each attracting different types of investors. From early ideation to late-stage expansion, understanding the Private Equity (PE) vs. Venture Capital (VC) dynamic is key to fundraising success.

Here’s a breakdown of the five primary startup funding phases:

1️⃣ Angel Stage (Pre-VC)

- Focus: Concept & Vision

- Investor Type: Angel Investors

- Funding Size: $10K – $250K

- Purpose: Seed ideas, build MVPs

- Examples: YCombinator, SVAngel, Initialized

2️⃣ Seed Stage (VC)

- Focus: Product Validation

- Investor Type: Venture Capital

- Funding Size: $250K – $2M

- Purpose: Team hiring, early traction

- Examples: Seed, Redpoint, Greylock

3️⃣ Growth Stage (VC/PE)

- Focus: Scaling Operations

- Investor Type: VC or PE

- Funding Size: $10M – $50M

- Purpose: Market expansion, user growth

- Examples: Bain Capital, Accel, PSG

4️⃣ Crossover Stage (PE)

- Focus: Profitability & Sustainability

- Investor Type: Private Equity

- Funding Size: $50M – $100M

- Purpose: Operational efficiency, M&A readiness

- Examples: Alkeon, SoftBank, Sands Capital

5️⃣ Late Stage / Buyout (PE)

- Focus: Exit Strategy

- Investor Type: Private Equity

- Funding Size: $100M+

- Purpose: IPO preparation or acquisition

- Examples: Silver Lake, Thoma Bravo, The Carlyle Group

🧠 TL;DR – Key Differences Between VC and PE

| Feature | Venture Capital (VC) | Private Equity (PE) |

|---|---|---|

| Typical Investment | Up to $10M | $50M and above |

| Stake Acquired | Minority | Majority/Controlling |

| Company Stage | Early-stage/startups | Mature/profitable businesses |

| Exit Focus | Growth, Series rounds | Buyout, IPO, M&A |

Conclusion:

While VCs fuel innovation at early stages, PEs focus on optimizing mature businesses for long-term returns. Knowing where your startup fits in this journey can help you target the right investors at the right time.