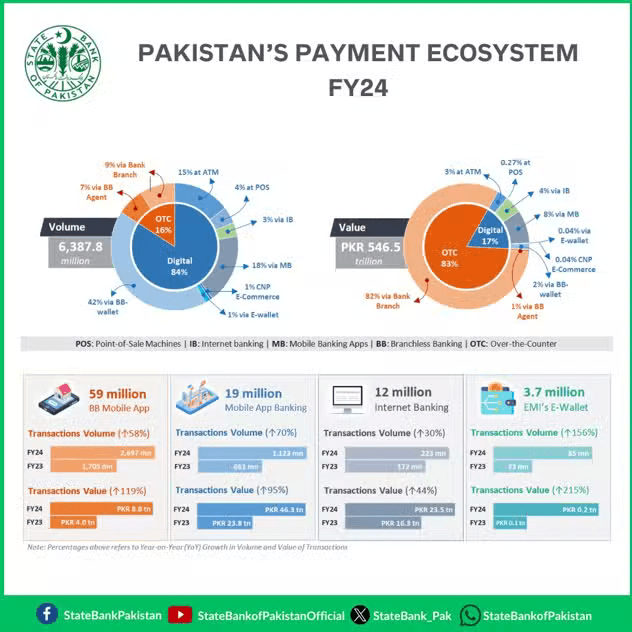

The State Bank of Pakistan (SBP) has unveiled its annual report for Fiscal Year 2023-24, showcasing an impressive leap in digital payments within the retail sector. Let’s dive into the highlights of this exciting transformation.

📊 Key Numbers from SBP’s 2023-24 Report

- Retail Transactions: Increased from 4.7 billion to 6.4 billion.

- Transaction Value: Jumped from Rs. 403 trillion to Rs. 547 trillion.

- Digital Payments Share: Grew from 76% to a remarkable 84% by volume.

The surge in digital transactions reflects the growing adoption of mobile banking apps, internet banking, and digital wallets across the country.

📱 Growth in Digital Channels: A Closer Look

The rise of mobile apps and online banking has been pivotal in driving the shift to digital. Here’s what the report reveals:

- Mobile App Banking Users: Increased by 16%.

- Internet Banking Users: Up by 25%.

- Branchless Banking (BB) Wallet Users: Grew by 2%.

- E-Wallet Users: A staggering 85% growth.

These figures highlight Pakistan’s rapid digital adoption as more people embrace the convenience of cashless transactions.

💼 A 62% Spike in Mobile & Internet Banking Transactions

Digital payments through mobile banking apps and internet portals saw explosive growth:

- 1,346 million transactions—a 62% increase!

- Total value of these transactions surged by 74%, reaching Rs. 70 trillion.

This showcases the pivotal role that digital banking plays in everyday commerce, from retail purchases to bills and beyond.

🛍️ POS Machines and E-Commerce Growth

The report also highlights significant developments in Point of Sale (POS) machines and e-commerce:

- POS Network: Expanded by 8.9% to 125,593 machines across Pakistan, driving card-based payments at more retail outlets.

- E-Commerce Payments: Shifted heavily towards digital channels, with 87% of payments now initiated through bank accounts or digital wallets.

A total of 309 million e-commerce payments were recorded, with a transaction value of Rs. 406 billion.

🔗 Reshaping the Future of Payments in Pakistan

The SBP’s report underscores the resilience and robustness of Pakistan’s payment infrastructure, positioning the country as a leader in digital financial services within the region. With a growing network of digital channels, mobile wallets, and POS systems, Pakistan’s journey toward a cashless economy is in full swing.